|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Your Home Meaning: Understanding the Process and Key ConsiderationsRefinancing your home can be a strategic financial move, but it's important to understand what it entails and how it can impact your financial situation. This article will delve into the meaning of refinancing, why homeowners consider it, and the factors to evaluate before making this decision. What Does It Mean to Refinance Your Home?Refinancing your home involves replacing your existing mortgage with a new one, typically to obtain better terms or a more favorable interest rate. Homeowners might refinance to lower monthly payments, reduce interest rates, or change the loan term. Common Reasons for Refinancing

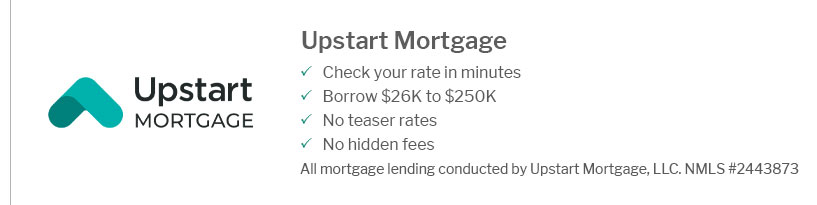

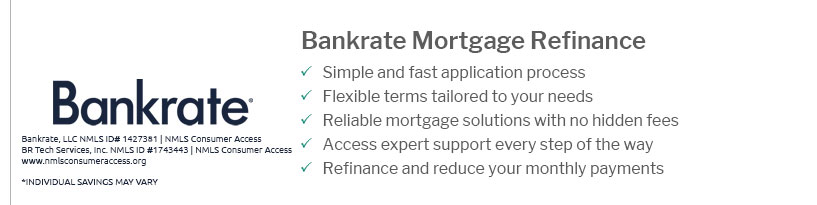

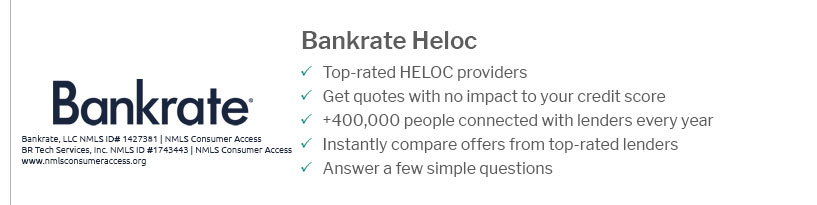

Key Considerations When RefinancingAssess Your Financial SituationBefore refinancing, evaluate your current financial position. Calculate potential savings against the costs of refinancing to ensure it aligns with your financial goals. Understand the CostsRefinancing comes with costs, including appraisal fees, closing costs, and other charges. It's crucial to understand these expenses and how they affect the overall benefit of refinancing. For a detailed breakdown, visit the average cost to refinance page. Choosing the Right LenderSelecting the right lender can impact your refinancing experience. Researching the best refinance banks can provide insights into competitive rates and customer service. Comparing Loan Offers

FAQsWhat is the typical cost of refinancing a home?The typical cost of refinancing can range from 2% to 5% of the loan amount. This includes various fees such as application, appraisal, and closing costs. How long does the refinancing process take?The refinancing process generally takes 30 to 45 days, but it can vary depending on the lender and the complexity of the loan. Can I refinance with bad credit?Yes, it's possible to refinance with bad credit, but it may result in higher interest rates. Improving your credit score before refinancing could lead to better terms. Refinancing your home is a significant financial decision that can offer numerous benefits if executed correctly. By understanding the process, evaluating your financial situation, and choosing the right lender, you can make an informed decision that aligns with your financial goals. https://www.investopedia.com/terms/r/refinance.asp

A refinance, or refi for short, refers to revising and replacing the terms of an existing credit agreement, usually as it relates to a loan or mortgage. https://www.visionretirement.com/articles/when-to-refinance-your-mortgage

Refinancing is the process of paying off an existing mortgage loan with a new one. Generally speaking, if refinancing can save you money, help you build ... https://firstintegrity.com/what-does-refinancing-a-house-mean/

Refinancing is the process of obtaining a new mortgage, usually with terms that are more favorable to the borrower, that way you can pay off and fully replace ...

|

|---|